green card exit tax amount

Likewise green card holders can avail themselves of the full annual gift tax exclusion from US. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

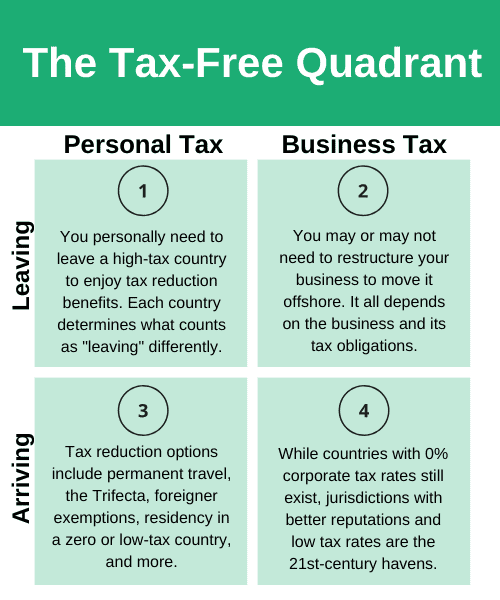

Exit Tax In The Us Everything You Need To Know If You Re Moving

Then they must determine the FMV on the day before expatriation.

. For spouses who expatriate each spouse files a. If you are covered then you will trigger the green card exit tax when you renounce your status. Gift tax indexed for inflation this amount is 15000 per donee and the full estate tax exemption from US.

Each asset is then calculated as if it was sole on the day before expatriation aka deemed sale Up to 725000 of the deemed gain is excluded. You cease to be a lawful permanent. Long-term green card holders may be subject to exit tax if they relinquish their green cards after being a lawful permanent resident for at least 8 years.

If you work from a company that withholds income taxes from your check then you should file a tax return. Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax. Your risk exists if.

It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. Note that the amount refers to net income any deductions that reduce your tax burden reduces the net income figure. Covered Expatriates and the Exit Tax.

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. The threshold amount for expatriations is 2017 is 162000 and it is indexed for inflation. The individuals annual net income tax liability for the prior five years was greater than 145000 2010 amount or.

For example if you made a profit of 750000 on your assets exit tax would only apply to 25000 of that amount. Also send a copy of your Form 8854 marked Copy to the address under Where To File later. You are a long-term resident which means you have held a green card in at least 8 of the previous 15 years IRC 877 e 2 877A g 5.

The exit tax rules apply to individuals who are considered covered expatriates For an individual who gives up his or her citizenship or green card to qualify as a covered expatriate one of the following must also apply. Green Card Exit Tax. The exclusion amount is indexed annually for inflation.

In summary when giving back your Green Card or renouncing your US citizenship it is important that you understand that you. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. In this first of our two-part series.

Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return including extensions. What is the departure expatriation or exit tax for US Green Card holders. The Exit Tax Planning rules in the United States are complex.

In order to determine if there is an exit tax. Abandon their green card status by filing Form I-407 with the US. If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax.

These are Five important factors to keep in mind before you begin the process. The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident. But if you are a Green Card holder and have only had it for.

Green card taxes are required for green card holders. If you are a covered expatriate the first 699000 of gain is shielded from the Exit Tax for 2017 expatriations. US Citizens are not the only people required to pay taxes to the US.

Your average annual net income tax for the past 5 years was 168000 for 2019. The IRS then takes this final gain and taxes it at the appropriate rates. Average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next.

Letting your green card expire and moving out of the United States without properly ending your residency with the US. 6 Golding Golding. Covered Expatriates may be subject to US Exit Tax.

Citizenship or long-term residency by non-citizens may trigger US. The average annual net income that you are taxed on for the five years before you expatriate is more than a set amount. Green card holders may be subjected to the exit tax rules when they.

Exit tax implications of the treaty election. New 8-Year Abandonment Rule 2021. About Our International Tax Law Firm.

Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation 162000 for 2017 165000 for 2018 168000 for 2019 and 171000 for 2020. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. Government revokes their green card visa status.

Permanent residents and green card holders are also required to pay taxes. In summary when giving back your Green Card or renouncing your US citizenship it is important that you understand that you. Contents hide 1 Long-Term Resident.

Citizenship and Immigration Services USCIS and the IRS could. In some cases you can be taxed up to 30 of your total net worth. For the 2022 calendar year the exclusion amount is US767000.

The Green Card Exit Tax 8-Years rule is complex. You could take advantage of the annual gift exclusion amount 15000 for 2018 and the applicable exclusion amount 11200000 for 2018 to transfer your assets to anyone including a specifically designed trust at. Estate tax under the newly enacted Tax Cuts and Jobs Act indexed for inflation this amount is 112 million per individual.

Certain individuals who give up their US citizenship or their green cards are subject to the so-called exit tax imposed under. The general rule is for US Green Card holders who have been in the US for 8 of the last 15 years or more with assets less than around 2 million they should escape. The expatriation tax consists of two components.

The amount is adjusted by inflation 2018s figure is 165000. If the profit on your assets is over 725000 you only have to pay exit tax on the amount that is over the threshold. 200000 71100 128900.

The covered expatriate must determine their basis in each asset.

Consigntill Easy To Use Point Of Sale Software Solution For Consignment And Resale Businesses Shopify E Commerce Business Starting A Business

Renouncing Us Citizenship Expat Tax Professionals

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Exit Tax Abandonment After 8 Years

Do Green Card Holders Living In The Uk Have To File Us Taxes

What Is Tax Residence And Why Does It Matter

Green Card Holder Exit Tax 8 Year Abandonment Rule New

15 Totally Genius Money Saving Hacks That Ll Blow Your Mind Of Life And Lisa Ways To Save Money Money Saving Tips Budgeting Finances

Getting Into The Real Estate Game And Buying Your First Investment Property Is Exciting And A Little Real Estate Investing Getting Into Real Estate Investing

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

5 Essential Steps To Financing Your Small Business Remember To Pursue Your Local Credit Union For Fund Internet Jobs Make More Money Small Business Resources

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Sales Tax Worksheets Money Math Worksheets Financial Literacy Worksheets Literacy Worksheets

Event Planner Invoice Template Fresh Invoice Template Event Planning Quotes Checklist Template

The Benefits Of A Green Card Boundless

Financial Literacy Word Wall Financial Literacy Lessons Consumer Math Financial Literacy

Us Tax Residency Status Explained Resident Or Nonresident

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly