irs tax attorney austin

If there is a federal tax lien on your home you must satisfy the lien before you can sell or refinance your home. If you visit the Austin IRS office please tell us about your experienceIt can be useful for others seeking help for a tax problem.

Irs Tax Audit Lawyers In Houston Tx

Rules Governing Practice before IRS Main navigation.

. We have opportunities for individuals interested in applying their analytical and investigative skills to educate customers on meeting their tax responsibilities while enforcing the tax laws. Nosuk Pak Kim 61 pleaded guilty Thursday to two counts of felony tax evasion in US. Due date of return.

Anderson Bradshaws tax professionals have helped thousands of businesses and individuals just like you resolve their tax issues andor IRS back taxes. Call us today at 877-550-3911 for a 30-minute Free Tax Consultation or fill out. Our tax attorneys can work with you to solve a wide array of IRS tax-related challenges including levy or wage enforcement.

The Internal Revenue Service IRS is the revenue service for the United States federal government which is responsible for collecting taxes and administering the Internal Revenue Code the main body of the federal statutory tax lawIt is part of the Department of the Treasury and led by the Commissioner of Internal Revenue who is appointed to a five-year term by the. Back taxes tax debt recovery and relief and IRS compliance issues. We can provide you with a reduced rate assessment for your first call to our offices at 800 681-1295.

The taxpayer agreed to immediate assessment of the tax but attempted to take advantage of the deduction for deficiency dividends under section 547. Pay by Debit Card Credit Card or Digital Wallet eg PayPal. In fact many members of our leadership and executive teams first began their IRS career as a Tax Law Specialist.

You can get help by phone or you can visit the office for in-person assistance. Use our directory to quickly find local attorneys and law firm ratings in your area. An entry-level position that opens possibilities.

Apply for an ITIN. We may just surprise you because were more than just the nations tax collection agency. Apply for an ITIN.

No fees from IRS. Apply for Power of Attorney Form W-7. Once you do a world of training and skills development will present itself to you as well as career progression and professional options.

Instructions for Form 1040 Form W-9. You should read the qualifications section very carefully to make sure that you meet all of the requirements for the position. You can enter the IRS as a Tax Law Specialist.

Apply for an ITIN Circular 230. Normally if you have equity in your property the tax lien is paid in part or in whole depending on the equity out of the sales proceeds at the time of closing. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live in.

So if youd like to make a change in your career one that comes with a. File Form 1040 or 1040-SR by April 18 2022. Find the best tax lawyer near you today.

Those inquiries must be addressed here. There are a number of options to satisfy the tax lien. Schedule payments up to a year in advance.

Pay Now with Direct Pay. Getting tax forms instructions and publications. Austin works for the Skidmore Tire Company a small business with 75 employees.

IR-2022-55 March 10 2022 To help serve taxpayers during this challenging tax season the Internal Revenue Service announced today that it is hiring more than 5000 positions in its service processing centers located in Austin Texas. Your bachelors or masters degree an interest in the world of finance and accounting and expertise in any number of career areas could qualify you for one of our exceptional. Skidmore has a SIMPLE IRA plan for its employees and will make a 2 nonelective contribution for each of them.

How well do you really know us. Publication 3 - Introductory Material Whats New Reminders Introduction. Apply for Power of Attorney Form W-7.

Austin Taxpayer Assistance Center is available to resolve your tax matters and clarify all your doubts. If you do join us you wont be disappointed with the many benefits we offer the opportunities for advancement or the dedicated. Austin - Internal Revenue Submission Processing Center 3651 S.

At the entry level you would. If you know or suspect that you are the target of an IRS criminal tax investigation contact the dual licensed Criminal Tax Defense Attorneys CPAs at the Tax Law Offices of David W. Go to the IRS Interactive Tax Assistant page at IRSgovHelpITA where you can find topics by using the search feature or viewing the categories listed.

Individual Tax Return Form 1040 Instructions. Phoenix ArizonaLittle Rock ArkansasLaguna Niguel CaliforniaOakland CaliforniaSacramento CaliforniaHartford ConnecticutWashington. And though our history can show you where weve been were always focused on the future.

Each IRS job has very specific qualifications that are explained in detail in each vacancy announcement. Please do not use this form for tax or stimulus check inquiries. Were looking for experienced individuals who know what they want out of their careers and who want an opportunity to make a real difference with one of the worlds largest financial institutions.

Tax Law Specialists have. Having a tax attorney on your side that practices virtue and candor is exactly what Tax Tiger provides. Americas Most Effective Tax Representation Company.

Apply for Power of Attorney Form W-7. Apply for Power of Attorney Form W-7. You will not receive any notification from the IRS unless your request is denied.

This position reviews tax returns for accuracy and completeness reviews and codes tax returns for computer processing resolves errors and corresponds with taxpayers to obtain any missing information. Find IRS addresses for private delivery of tax returns. A Newport News attorney has agreed to pay the IRS 869000 in back taxes after admitting to federal tax fraud.

The IRS can end the choice for any tax year that either spouse has failed to keep adequate books records and other information necessary to determine the correct income tax. The IRS does not send unsolicited email text messages or use social media to discuss your personal tax issueIf you receive a telephone call from someone claiming to be an IRS employee and demanding money you should consult the IRS Tax ScamsConsumer Alerts webpageIf you know you dont owe taxes or have no reason to believe that you do. Under this option even if a Skidmore employee does not contribute to his or her SIMPLE IRA that employee would still receive an employer contribution to.

Were an organization that has been part of events that have helped shape the nation we serve. Business and Tax Enforcement is a vital part of the IRS. Set us as your home page and never miss the news that matters to you.

If you want to apply your accounting skills to a role that puts you directly in touch with numbers you should be one of our Tax Examiners. Use FindLaw to hire a local tax lawyer near you to help structure an offer and compromise fight IRS collections and assist with wage and. The IRS audited the taxpayers tax returns for 2014 2015 and 2016 and determined that the taxpayer was a personal holding company liable for personal holding company tax.

Apply for an ITIN.

Taxes And Your Tcdrs Benefit Tcdrs

How To Spot And Handle A Fake Irs Letter Bench Accounting

San Antonio Tax Attorney Forte Tax Law Tax Law Firm

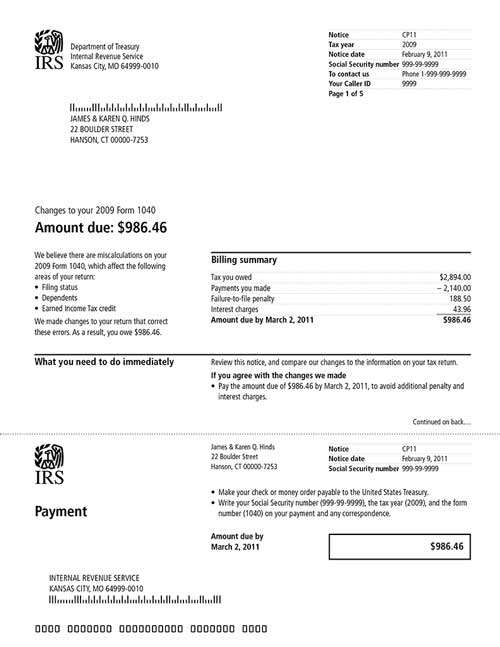

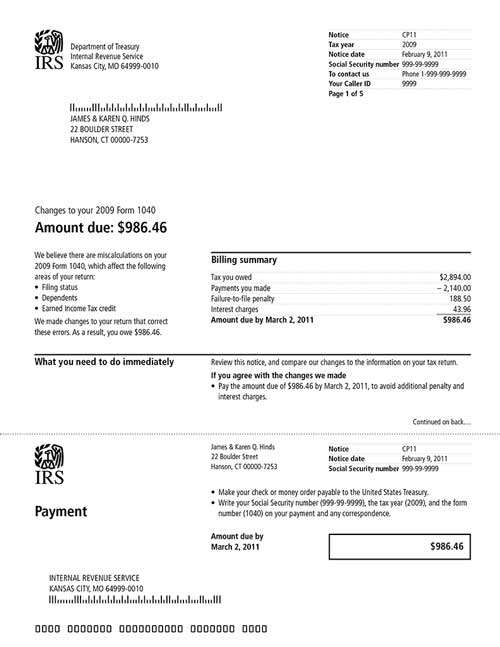

What To Do About Irs Notice Cp11 The Tax Lawyer

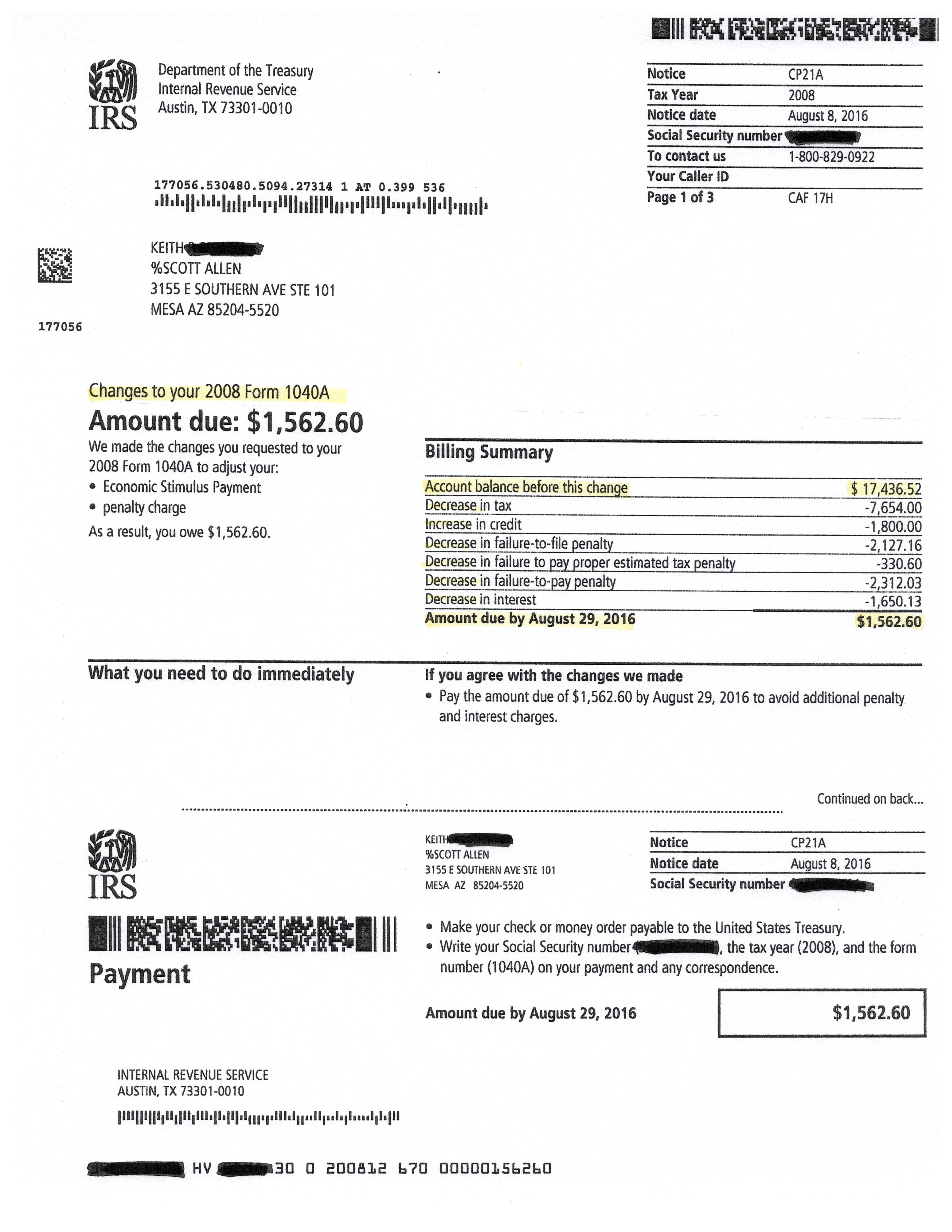

Irs Notice Cp22a Changes To Your Form 1040 H R Block

Alex Jones Gets 49 3m Tax Write Off Plaintiffs Have To Pay Irs Tax On Verdict

Commissioner Charles P Rettig Internal Revenue Service

Irs Letter 4464c Notice Of Intent To Review Return

When You Put The 2 Words The And Irs Together It Spells Theirs Irs Taxes Irs Tax Day

Irs Tax Audits Page 2 Tax Debt Advisors

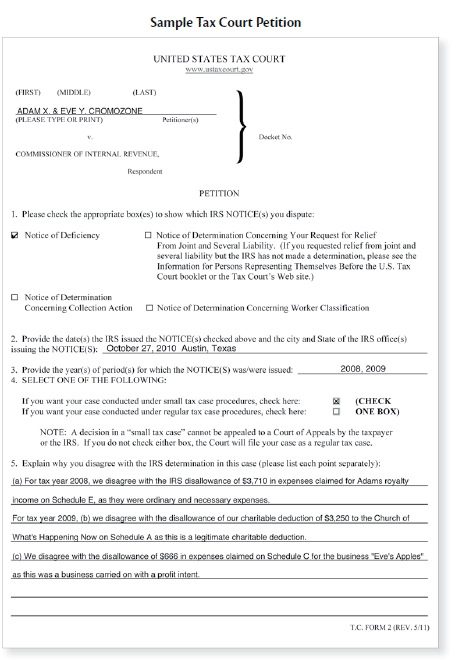

Irs Tax Court Standing Up To The Irs Law Offices Of Daily Montfort Toups

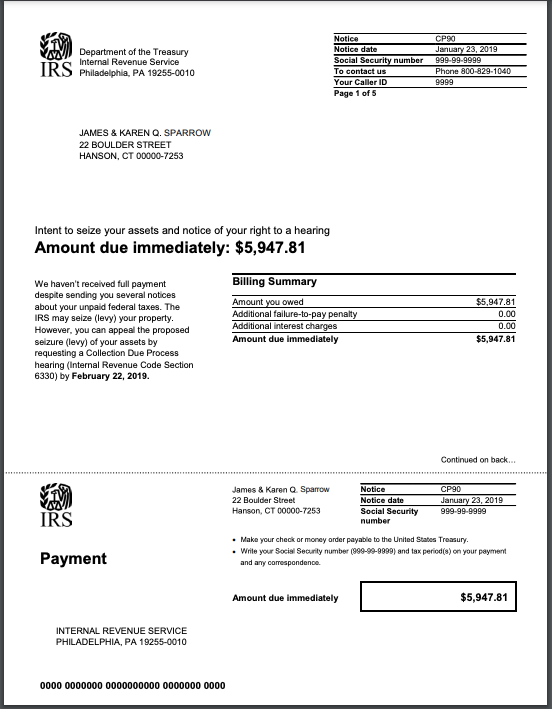

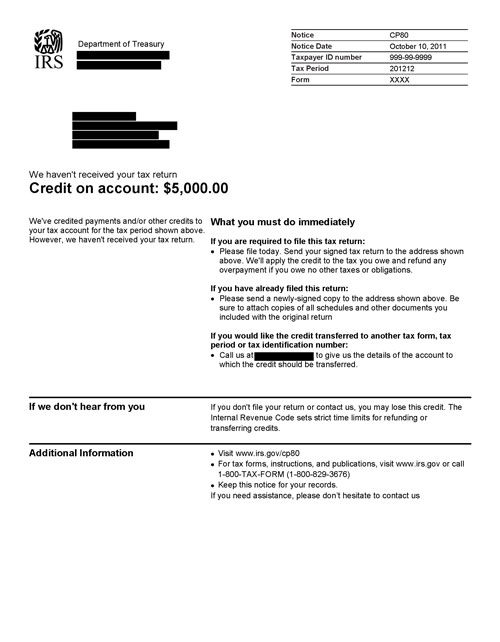

Irs Notice Cp80 What You Must Do

There Are Individuals Out There Who Requires Help With Tax But Cannot Afford A Taxattorney They Can Always Look For Afford Tax Attorney Tax Lawyer Tax Refund

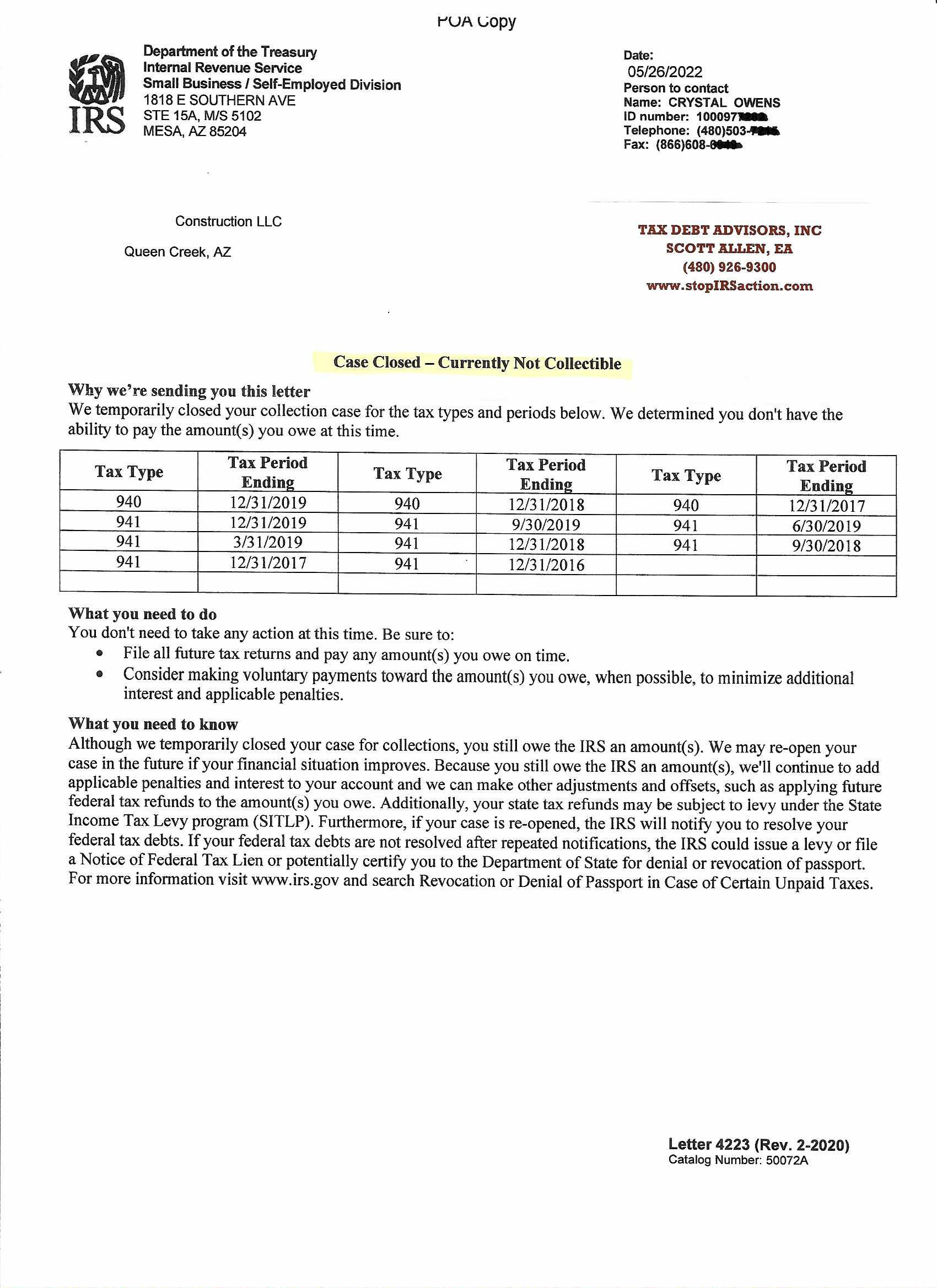

Chandler Az Irs Tax Attorney Tax Debt Advisors

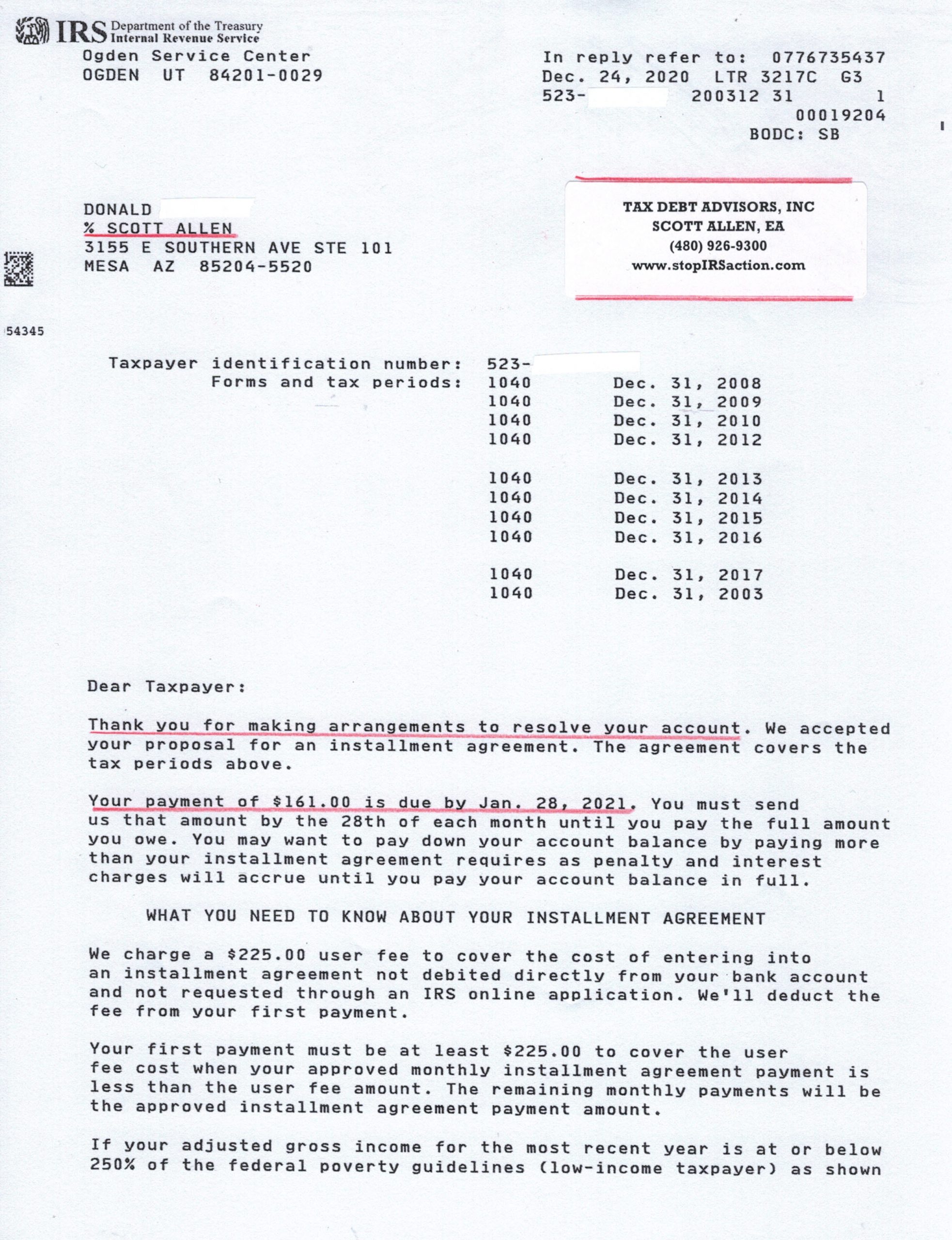

Irs Tax Audits Tax Debt Advisors

Irs Letter 39 Lt39 Reminder Of Overdue Taxes H R Block

Tax Attorneys Tax Debt Relief In Texas Instant Tax Solutions